Modernize cybersecurity supervision

Implement a systematic approach to manage cyber risk at scale and focus on the areas with the most significant security and compliance risk

Supplement traditional examinations with security insights at scale

Regulators are tasked with safeguarding the financial system, preventing data breaches, and protecting both consumers and the broader economy from the severe consequences of such incidents. Manual, point-in-time assessments leave oversight gaps. SecurityScorecard provides a holistic view of cybersecurity risks, enabling effective engagement and supervision.

A View Inside

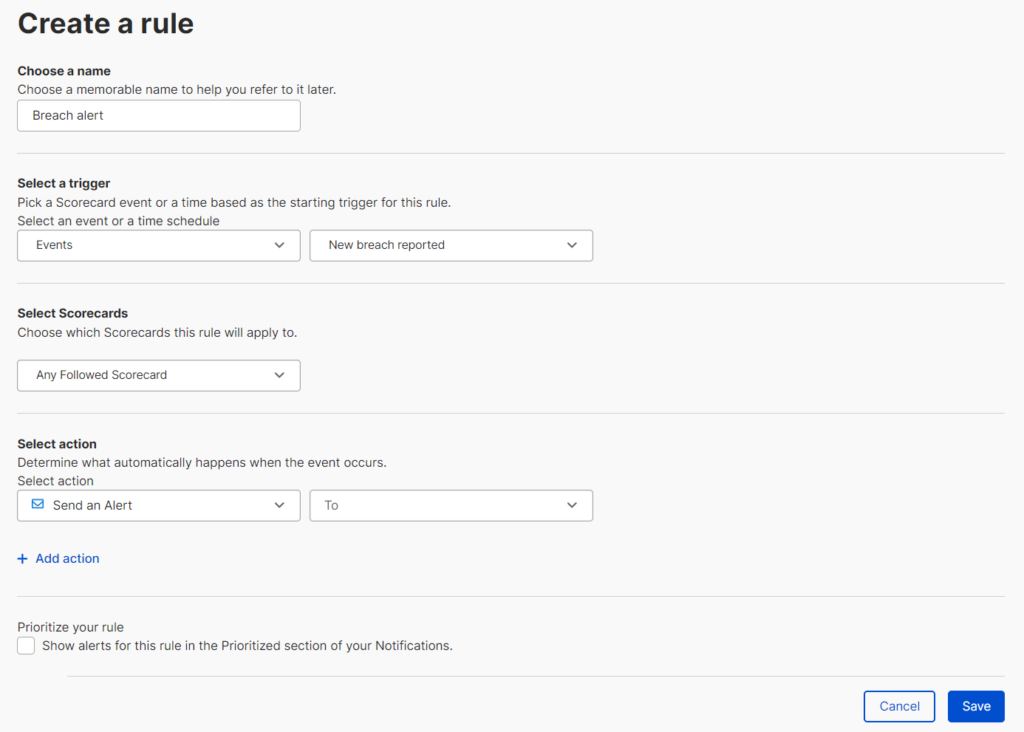

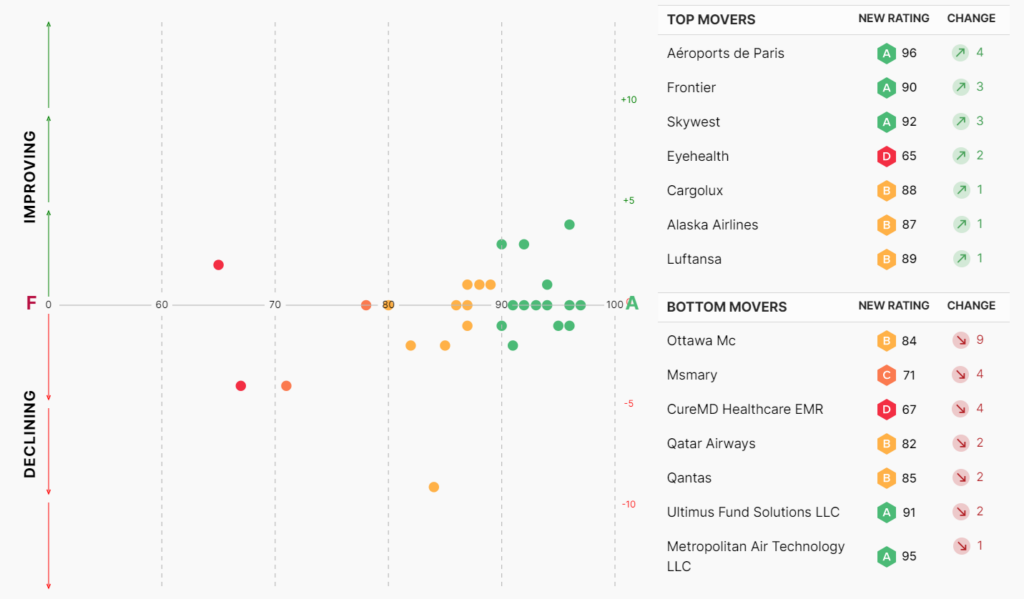

See the product in action

Outcomes

Close the gaps on oversight and compliance

-

Increase examination productivity

Independently identify issues and focus time towards proactively resolving the most impactful issues

-

Prioritize examinations of at-risk entities

Allocate resources towards supporting entities who are actively being targeted or are showing indicator of compromise

-

Strengthen relationships with regulated entities

Deliver timely, relevant, and actionable advice on remediating active threats

Critical Capabilities

-

Non-intrusive scanning

Gain a full picture of any entity’s security posture to assess risk

-

AI-powered workflows

Prioritize areas of focus, enable automation, and drive action with predictive incident data

-

Continuous risk monitoring

Stay informed of new issues and emerging threats with real-time data

-

Common risk management platform

Invite industry stakeholders to review findings and collaborate on risk resolution

Hear from our Customers

-

“By adding SecurityScorecard’s technology to our existing cybersecurity resources, we are ensuring that our members have the best tools available for continuing to protect the financial system from cyberattacks.”

Mary Beth Quist CSBS Senior Vice President, Bank Supervision1 / 0

-

"Ensuring that Maryland financial institutions monitor, identify and remediate cybersecurity threats is a critical component of our mission, especially as consumers increasingly embrace emerging technologies like blockchain, online banking and digital payment systems.”

Commissioner of Financial Regulation Tony Salazar1 / 0